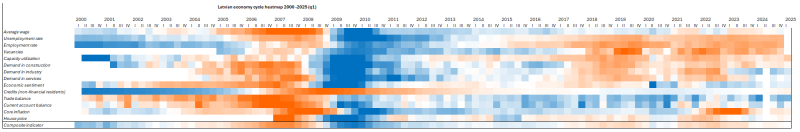

Each quarter, the Fiscal Discipline Council, like other independent fiscal institutions within the European Union member states, compiles a heat map of the economic cycle. Long-term data from the first quarter of 2000 to the first quarter of 2025 is available in MS Excel format [here].

In the first quarter of 2025, the composite economic heat map index remained unchanged at 0.1%, indicating the continuation of a shallow recession.

Wage growth remained stable, and for the first time after several quarters, salary growth in the private sector exceeded that in the public sector. At the same time, the labour market showed signs of cooling — unemployment increased slightly, employment declined, and the number of job vacancies in the public sector continued to shrink, while it grew in the private sector.

Production capacity utilisation increased significantly, but weak demand remained a key limiting factor. Lending activity showed signs of growth — new loans for housing and businesses rose rapidly, although this increase occurred in comparison to previously low lending levels.

In external trade, moderate export growth was observed, but both the trade balance and the current account remained in deficit. Core inflation in Latvia was above 3% and continued to exceed the euro area level. Housing prices continued to rise in both the new and existing housing segments.

More on these and other developments can be found in the Latvian Economic Heat Map for first quarter 2025.

Source: Central Statistical Bureau, Bank of Latvia, Eurostat, FDC calculations

Wage growth continued in the first quarter of 2025, and the growth rate remained unchanged. However, wage growth in the private sector outpaced that in the public sector.

The average monthly gross wage in the first quarter of 2025 increased by 8.3% compared to the same period in the previous year, reaching 1,757 euros. The growth rate remained the same as in the previous quarter (also 8.3% in Q4 2024), indicating relative stability in wage dynamics.

In the private sector, wages grew faster — by 9.4%, reaching 1,766 euros, while in the public sector the increase was more moderate — 5.8%, with the average gross wage at 1,753 euros. This was the first quarter in several where private sector wage growth exceeded public sector indicators.

The median gross wage in Q1 2025 was 1,403 euros, an increase of 8.5% year-on-year. This means that half of Latvian employees earned less than this amount, and half earned more.

Net wage indicators grew even more rapidly: the average monthly net wage reached 1,305 euros, up 10.6% year-on-year. The net median wage was 1,076 euros, a 12.4% increase, indicating a significant rise in real incomes.

In the private sector, net wages reached 1,311 euros (+11.8%), and in the public sector — 1,303 euros (+8.1%).

In the first quarter of 2025, the labour market continued to cool — unemployment increased, the employment rate declined slightly, and the number of vacancies decreased in the public sector and increased in the private sector.

The unemployment rate in Latvia rose to 7.2%, an increase of 0.3 percentage points compared to Q4 2024. In the European Union, the average unemployment rate was 6.0%, while in the Baltic States the highest rate was in Estonia (8.3%) and the lowest in Lithuania (6.5%).

The employment rate in Latvia dropped to 63.2%, down from 63.4% in the previous quarter. The total number of employed persons was 868,000, or 1.4% less than in Q1 2024. By gender, the employment rate was 65.9% for men and 60.7% for women.

The number of job vacancies in Q1 2025 increased by 3.8% compared to the previous quarter, reaching 21,500. However, compared to the same period a year earlier, it declined by 12.2%.

Vacancies in the public sector continued to decrease — by 6.6% quarter-on-quarter and 13.1% year-on-year, reaching 9,635. In the private sector, the opposite trend was observed — the number of vacancies rose by 14% compared to the previous quarter, reaching 11,900, though this still represented an 11.4% year-on-year decline.

Enterprise capacity utilisation increased in the first quarter of 2025. However, lack of demand remained a key factor limiting operations in several sectors.

Capacity utilisation in Latvia rose to 74%, compared to 72.4% in the previous quarter — the highest level since the end of 2022. Despite the improvement, Latvia still lags behind the eurozone average of 77.3%.

Weak demand remains a significant constraint on business activity, though its impact varies across industries.

According to an in-depth survey conducted by the Central Statistical Bureau, 44.7% of manufacturing companies cited weak demand as a limiting factor — a slight decrease from Q4 2024.

In the construction sector, 38.2% of companies reported demand-related challenges — one of the highest levels in recent years. This came despite a 9% rise in construction output, mostly driven by civil engineering, pointing to an uneven situation across the sector.

In the services sector, 35.3% of companies cited weak demand, a figure that has remained stable in recent quarters.

The economic sentiment indicator in Q1 2025 stood at 98.0, almost unchanged from the previous quarter (98.1%), suggesting a cautious but relatively stable outlook among businesses.

The credit market continued to recover in the first quarter of 2025 — new lending to both businesses and households increased, particularly outside the consumer loan segment.

Data from the Bank of Latvia show that the total loan portfolio reached 11.48 billion euros in Q1 2025, up 2.3% compared to a year earlier. The loan balance for non-financial corporations rose by 9.5%, while household loans increased by 7.3%.

Growth in new lending was particularly strong. New loans to households for housing increased by 67% compared to Q1 2024. Other household loans rose by 90%, while growth in consumer credit was more modest — just 10%, suggesting a stabilisation after earlier rapid growth. New loans to businesses grew by 93%, indicating renewed activity in investment and working capital financing.

These developments point to a strong recovery in the lending market, though growth is also influenced by a low base from previous years.

Foreign trade indicators in Q1 2025 showed mixed trends — export growth continued, but the trade deficit remained relatively high.

The trade deficit stood at 6.9% of GDP, similar to the previous quarter (6.6%). At the same time, export value grew by 3.2% year-on-year — one of the strongest performances since 2022. Despite previous declines, this growth points to a gradual recovery in external demand.

The current account recorded a deficit of 4.1% of GDP in Q1 2025, compared to a small surplus (0.8%) in the previous quarter. The deficit was mainly due to a negative primary income balance (–1.7%), including payments to foreign investors for profits, interest, and wages. The secondary income balance — mainly remittances and inter-country transfers — posted a surplus of 1.9%, slightly lower than in Q4 2024.

Latvia's core inflation declined slightly in Q1 2025, but remained higher than in the euro area.

Core inflation was 3.5% in Q1 2025, down from 3.8% in the previous quarter. In the euro area, core inflation during the same period was 2.6%. Core inflation measures price changes excluding volatile items such as food and energy. It helps track longer-term price trends in the economy.

House prices continued to rise in Q1 2025, though year-on-year growth slowed slightly compared to late 2024.

Compared to the same period in 2024, overall house prices increased by 5.8%. This was less than the 7.3% rise seen in Q4 2024, but still reflects sustained growth in the housing market.

Prices for new dwellings rose by 6.5% year-on-year, recovering from slower growth in the previous quarter (4.2%). Prices for existing dwellings grew by 5.5%, slower than the 8.2% rise in Q4 2024, but significantly higher than most of 2023 and 2024.